Bitcoin vs Gold as means of saving moneyThe current status of Bitcoin, which is the first decentralized digital currency, and the technical difficulties it has overcome give it the full right to accept the status of a virtual equivalent of gold.

Comparison of Bitcoin and gold

It is logical to ask whether Bitcoin is really comparable to gold, and in what sense exactly? In fact, the whole point is to determine which of the two options is the best mean of saving.

But first, what is Bitcoin?

- Definition of a mean of saving

In modern monetary theory, a means of saving is something that transfers purchasing power over time. That is, if at some point you have an asset that can be exchanged for the equivalent of a month’s salary, and twenty years later it can still be exchanged for the equivalent of a month’s salary, despite currency inflation, this asset is a good means of saving.

It is commonly believed that paper currency, gold, or even real estate is a means of saving. And if these are means of saving, why not Bitcoin? This is a question that is by no means obvious to many people unfamiliar with cryptocurrency.

- Fluctuating stocks

You should know that, despite their recognized nature as means of saving, the prices of gold and real estate sometimes fall sharply during the crisis. And in good times, their prices could rise sharply.

And since the comparison focuses on gold, if we analyze its price adjusted for inflation today, know that it was multiplied by 11 between 1970 and 1980, and then divided by almost 3, between 1980 and 1984, and again divided by 2, between 1984 and 2001. For those who bought gold in 1980, their purchase was a waste of money for 30 years, until 2011, when prices briefly returned to what they paid in 1980.

But they didn’t make profit! At best, some of them, after 30 years of waiting, with huge losses received fifteen months, so as not to lose more than 10% of what they invested. So this is a far cry from what people think of gold today. Its value has not remained stable over time. It is simply less volatile than some other assets.

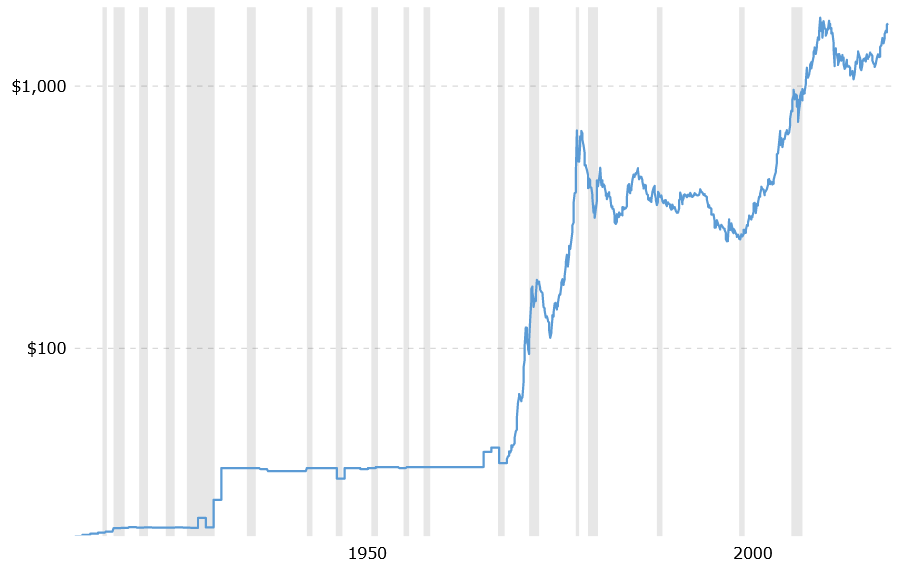

The price of gold over time

Gold prices by year adjusted for inflation

The decline in the value of gold is less obvious if we look only at the initial values, without taking into account inflation: on the curve, the price of gold rose from $ 660 to the highest level. Maximum in 1980, up to $ 320 in 1984. As for the numerical value, buyers with the maximum level in 1980 lost money only until 2006. Which is not much better, but less. It is noteworthy that the calculations take into account inflation.

The price of gold over the years and the gross value

In addition, real estate in general is constantly becoming more expensive due to population growth. Of course, it all depends on the location. In some suburbs or rural areas, housing prices don’t necessarily stay the same over time. But the fact remains that compared to gold, real estate rarely experiences such sharp declines, except during the war.

Despite the sharp drop in value that we saw not so long ago, gold is still a means of saving.

What can we say about the currency? According to all the great economists of this world, the means of saving is an essential function of money. In other words, regardless of the situation of the issuing government, the currency is always a means of saving. But this was not the case.

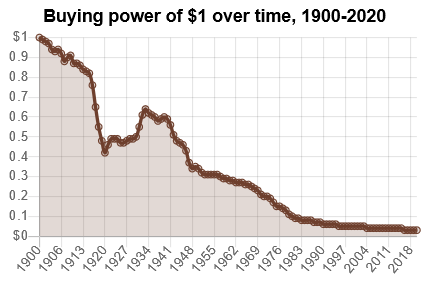

Purchasing power of the US dollar in different years

According to this chart, a dollar in 1980 has the same value as $ 3 and 13 cents in 2020. So an American who set aside $ 1,000 in 1980 in banknotes will get $ 1,000 in 2020, but they can only use it to buy three times as many things with it, because what cost $ 1,000 in 1980 is worth $ 3,130 in 2020.

And this fall in the value of the US dollar has been going on for more than 120 years. Since 1900, the dollar has experienced almost constant inflation, and so has slowly lost value each year. The only exception was the period between 1920 and 1934, but this small increase followed a dizzying fall, and only allowed the dollar to continue devaluing at the same rate as before.

This is not a trend that is constantly changing, like the price of gold. The number of existing US dollars is constantly increasing, and its value decreases slightly with each new dollar created: this is inflation. So why is it even considered a means of saving?

Origin of the definition

This may seem surprising, but money is considered a means of saving, because this definition is so old that very few people doubt it.

The character who established this definition is actually Aristotle.

In the time of Aristotle, coins were a very recent concept that existed for about 400 years. The monetary system was still unstable, so the idea of Aristotle on the means of savings is not necessarily consistent with contemporary standards.

And when we analyze his text in more detail, we understand that Aristotle primarily meant by “means of saving” that the material from which money is made must have an intrinsic value.

In other words, an item used as money must have had value before it became money. Because if the material chosen as money had no value, then the money in question could not have become money when this concept was invented.

Indeed, the first people who needed to trade did not immediately think that they were going to draw numbers on small pieces of parchment. They used coins made of precious metals, because precious metals were valuable.

Therefore, in Aristotle’s original definition, the value of each coin must be the same as the amount indicated above. The materials in the coin of the ruble should be worth one ruble, and so on.

But he also acknowledges elsewhere that civilization has already deviated from this ideal in his day, and that money no longer necessarily has intrinsic value.

So, for Aristotle more than 2,300 years ago, currencies were not always a “real” mean of saving. In particular, it expresses the idea that their value depends only on the law, which is the product of the will of people. In other words, they are subject to sudden and unpredictable changes. And he even claims about money in his work “Ethics in Nicomac” that we have the power to change it, and make it useless.

But all this interests us less than the definition of a mean of saving, which is hidden behind the definition of money. In defining money, Aristotle also defined a mean of saving as an object with an intrinsic value.

Applying the definition

Going back to the us dollar, Bitcoin, and gold, it seems completely hypocritical to consider the dollar as a means of saving while simultaneously excluding Bitcoin from this category.

The value of the dollar is based only on trust in the US government and the fed, the Federal reserve system (the paper itself is worth nothing). While the basis of Bitcoin’s value to some extent is trust in other users of the network, as well as mathematical rules and some waste of energy.

Even if all this remains immaterial, we can assume that the value of the cue Ball depends on elements that are slightly more “specific” than the value of the dollar. And if the dollar is still seen as a means of saving, despite its steady decline for more than a century, then Bitcoin should also be able to do so.

Indeed, if the dollar today is a mean of saving, then we must recognize that Aristotle’s definition of mean of saving is no longer fully applicable today, and that it must now be extended to assets whose value is supported by intangible elements.

With this definition, crypto can be considered as a mean of saving. But can we say that Bitcoin is a good store of value? There is nothing better than comparing it to gold.

Practical aspect

Theory is one thing, but to find out which of the two options is the best means of saving, you need to look at practice. In this area, Bitcoin and gold have comparable advantages and disadvantages.

- Security and preservation

When it comes to security, these two assets are somehow connected. Bitcoin is an asset that can be stolen as a result of hacking, and gold can disappear as a result of burglary. And in the event of a natural disaster, both gold and cryptocurrency may be lost. In the case of bitcoin, this will be because It becomes unavailable after the private key is destroyed, but the result is the same.

However, it should be recognized that it is generally more difficult for society to take the right measures when it comes to computer security than when it comes to physical security. The computer is even more difficult to understand than the storage. At the same time, the safe is expensive, and VeraCrypt is free.

The only conclusion that can be drawn at the moment is that gold and PTS are comparable in terms of ease of use and storage. In fact, there is not much advantage on one side or the other.

- Ease of use

Another important characteristic of a savings vehicle is its ease of movement and exchange.

As for gold, buying and selling is possible, but only at a cost that is neither too high nor too small. When you buy gold it usually has a pre-defined format. It is difficult to exchange gold for a fraction of a penny, just as it is difficult to exchange the amount of gold in a million rubles.

In case of Bitcoin, these restrictions disappear: it is as easy to exchange a thousandth part of Fiat in Bitcoins or exchange ten million rubles for PTS as it is to exchange fifty, one hundred or one thousand rubles in BTC.

In addition, you don’t need to travel in person to trade crypts, unlike gold. This makes it much easier to exchange crypto assets with someone who is far away from you.

In this category, the only advantage of gold is that it can be traded even in “catastrophic” scenarios, such as nuclear war. Indeed, the latter would destroy almost all electronic devices on Earth at the same time due to the generated electromagnetic pulse. And without an electronic device, there are no Bitcoins.

- Efficiency to save value

The basis for comparing gold and Bitcoin is the ability of each of them to retain value over time. Indeed, gold has always been seen as a great way to provide value, and for several decades now-as a very reliable investment, the value of which is constantly growing.

What about Bitcoin?

- Q-ty in stock

A good store of value is first of all an object that is unusual enough to have a high value. Because although water or wood has a constant global value, it is very low. And, therefore, you need a lot of space to store a lot of value in it. In contrast, gold can store a lot of value in a relatively small space.

To store 10,000 euros in gold, you will need a bag, and for wood, you will need a little more space.

And this is mainly because gold is scarce, and therefore it is a practical means of saving.

Bitcoin is also a rarity: there are only 21 million. This number can be changed because it is only the result of an unwritten rule, which is the consensus rule of network users. But it is extremely unlikely that it will change, since changing this number will lead to a dilution of everyone’s assets, which is contrary to the interests of network users.

Therefore, to change the amount of a crypto asset, a large part of the network will have to go against its own interests. The extreme improbability of such a decision.

Now let’s try to anticipate the situation in the long term, and in the very long term. In what potential situation would a shortage of gold or Bitcoin be at risk?

As for gold, its deficit will inevitably decrease over time. But the numbers we have are very inaccurate, and we don’t really know how much gold humanity has.

According to more generally accepted data, today we have between 150,000 and 200,000 tons of gold in our hands. And there will be about 52,000 tons to be extracted from known and fairly close deposits, with the full depletion of this resource expected between 2032 and 2050.

What about Bitcoin at the moment? In principle, the number of coins will remain as limited as it is today, except in cases where the majority of network users will support changing the number of existing Bitcoins. This is very unlikely.

However, it is possible that bitcoin will lose its place at the top of the class and be replaced by another crypto asset: randomly, something that offers anonymity to its users or can be used to create smart contracts, and other features that we haven’t dreamed of yet.

Fortunately for it, under any circumstances, BTC will remain BTC, and its status as the first cryptocurrency may well ensure it a certain place in the Pantheon of savings, despite the disadvantages. The importance of its status as the father of cryptocurrency should not be underestimated, which in itself is significant for a large number of investors. It retains value.

The historical stability

Many will argue that while bitcoin is a store of value like gold, it is much easier to destroy than gold.

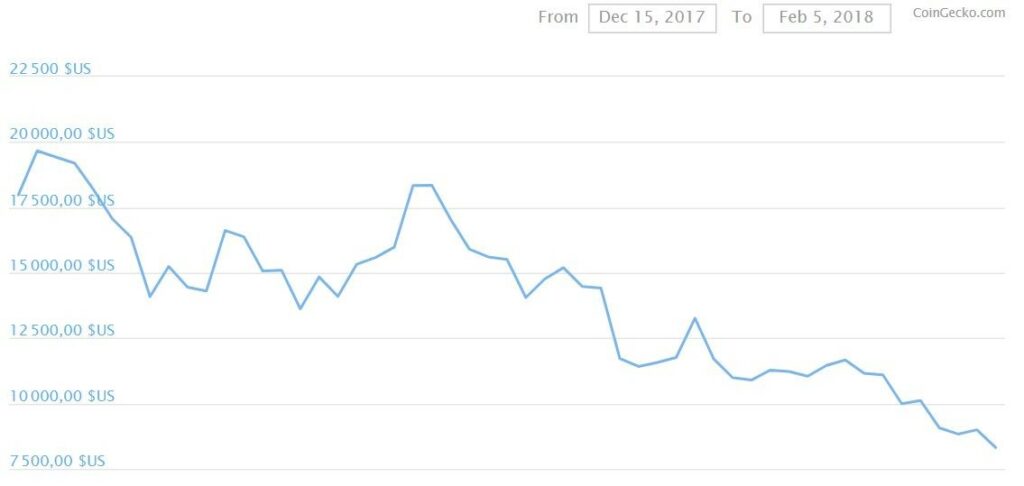

Indeed, as we already know, gold lost 70% of its value between 1980 and 1984, while Bitcoin did the same from December 16, 2017 to February 6, 2018.

Bitcoin price dynamics from December 15, 2017 to February 5, 2018

But this difference in results can be explained, on the one hand, by the difference in height between them, and on the other – by the difference in age.

Bitcoin is too young and not widely used to achieve a good level of stability. This is because an asset whose value depends on the market becomes stable only if it is a market with a large number of participants. And this is all the more true when the asset in question does not have a specific use.

While gold has been an integral part of society for centuries, is used in dozens of different industries, and is a speculative commodity known to the vast majority of the population, Bitcoin is still an innovation. And the number of users of the Bitcoin network is extremely small compared to the number of people and companies using gold.

Today, much of the price of Bitcoin is the result of market manipulation by major players in the sector, and we will have to wait until cryptocurrencies develop and integrate into society before we see Bitcoin as stable as gold. But it has already proven to be an excellent means of saving money. It is the first asset to recover from the March crash in global markets, and continues to grow.

Conclusion

For many, gold is clearly still a more valuable asset today. But in the near future, Bitcoin can once again prove its productivity.

And after a while, gold may completely lose its character as a means of saving. When that moment comes, no one will have any doubts about Bitcoin.